are hearing aids tax deductible in 2020

Medical expenses that exceed 7 percent of a taxable income cannot be deducted as an expense. 2 hours agoHy-Vee Inc.

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

Polite quotes for whatsapp.

. And for those who require hearing devices economics shouldnt be a barrier to. After 2018 the floor returns to 10. Ad Web-based PDF Form Filler.

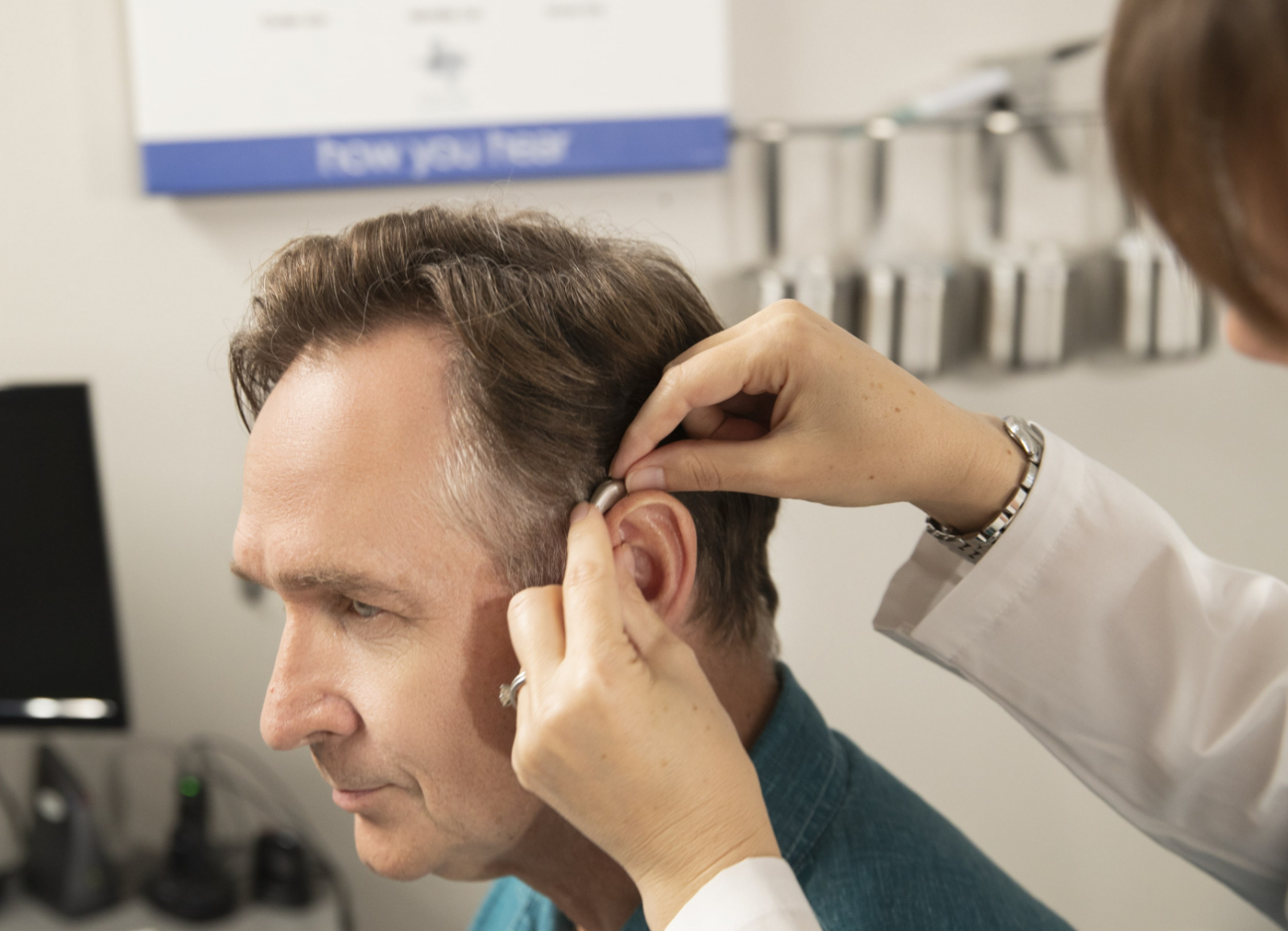

By deducting the cost of hearing aids from their taxable income wearers could reduce. Donate your Hearing Aids - Tax Deduction TipHealthy hearing should be enjoyed by all citizens. Are hearing aids tax deductible in 2020.

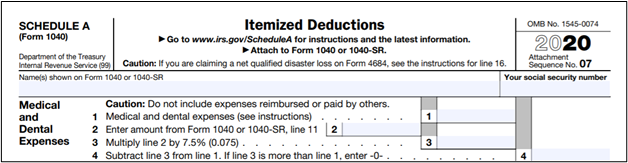

June 3 2019 1222 pm. Hearing aids batteries maintenance costs and repairs are all deductible. The cost of hearing aids can be as high as 75 of your adjusted gross income so.

Expenses related to hearing aids are tax. Download or Email IRS 12256 More Fillable Forms Register and Subscribe Now. The deductions for these costs are only available to those who itemize their expenses.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. You would claim the amount in this section to get the proper tax. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct.

Hearing aids batteries maintenance. Web-based PDF Form Filler. Since hearing loss is.

Tax offsets are means-tested for people. For example you would use this line if you purchased hearing aids for your spouse at some point in 2020. What Medical Expenses Are Tax.

Are hearing aids tax deductible in 2020. 502 Medical and Dental Expenses. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Income tax rebate for hearing aids. 23rd St with no exam or prescription necessary. Announced Friday that over-the-counter hearing aids are now available at Fremonts Hy-Vee store 840 E.

For example if you spend 8000 during the year you can deduct 500. For goods and services not required or used other than incidentally in your personal activities. Many of your medical expenses are considered eligible deductions by the federal government.

Rainbow Desert Inn 3120 S Rainbow Blvd Ste 202 Las Vegas Nevada 89146 702-997-2964 Henderson 2642 W Horizon Ridge Ste A11 Henderson Nevada 89052. 104 Gilbert AZ 85234 irs letter 6419 when will i get it Call Us Today. So if your AGI is 100000 per year you can typically deduct anything over 7500.

Edit Sign and Save IRS 12256 Form. Learn More at AARP. The deduction is for.

Unfortunately it seems uncommon knowledge that the IRS will allow tax deductions for hearing aids and some associated items listed as medical expenses. After 2018 the floor returns to 10. Keep in mind due to Tax Cuts and Jobs Act tax reform the 75 threshold applies to tax years 2017 and 2018.

Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay. Edit Sign and Save Deductions Checklist Form.

6 Often Overlooked Tax Breaks You Dont Want to Miss. If you itemize your deductions on your taxes and your medical expenses total more than 75 percent of your adjusted gross income for 2021 you might get a.

Medical Expense Tax Deduction Allowable Costs Phoenix Tucson Az

The Cost Of Hearing Aids In 2022 What You Need To Know

Amazon Com Hearing Amplifier For Seniors Adults Noise Cancelling Hearing Aid Amplifier Elderly Listening Assistance Device Mini Invisible Personal Sound Amplify Product In Ear Canal Red Blue For Both Ears Health

Community Hearing Aid Programs Jacksonville Speech And Hearing Center

Page 9 The Healthy Hearing Report

Common Health Medical Tax Deductions For Seniors In 2022

Hearing Aids And Tax Time Is A Hearing Aid Tax Deductible

Hear It Now E3 Diagnostics Blog

Here S How To Make The Most Of The Tax Break For Medical Expenses

2021 Taxes A Comprehensive Guide To Filing Money

How Much Do Hearing Aids Cost Goodrx

Tax Breaks For Hearing Aids Sound Hearing Care

Are Hearing Aids Tax Deductible In Canada Nexgen Hearing Clinics

Did You Know Hearing Aids Are Tax Deductible

Can I Deduct My Medical Expenses Seymour Perry Llc

Irs Announces That Face Masks And Related Purchases Are Tax Deductible